Welcome to the forefront of Kaspa mining in 2024! As we dive into the realm of digital currency, Kaspa stands out with its lightning-fast proof-of-work and decentralized nature. Boasting the revolutionary blockDAG architecture, Kaspa ensures greater mining decentralization and effective solo-mining for lower hash rates. With its fair launch in November 2021, no pre-mine, pre-sales, or coin allocations, Kaspa champions a 100% decentralized, open-source, and community-managed ethos. With a total supply of 28.7 billion coins and a unique emission schedule, the journey of Kaspa mining is as intriguing as it is rewarding.

Kaspa’s mining process is anchored in the kHeavyHash algorithm—a modified, energy-efficient version of HeavyHash optimized for GPU and future mining technologies. This innovative approach promises a fair and accessible mining experience for all.

Block Reward: 123.47 KAS

Circulating Supply: 23.01B KAS

Hash Rate: 180239.0 TH/s

Market Cap: $3.4B

Diving into Kaspa Mining Software

For those looking to join the mining adventure, choosing the right software is crucial. Popular options include:

LOLMINER | BZMINER | SRBMINER | TEAM RED MINER | KASPAMINER | GMINER

These tools are your gateway to securing the network and earning valuable block rewards.

Exploring Kaspa Mining Pools

Solo mining or pool mining? That’s a question many miners face. Here’s a list of current pool options to help you decide:

ANTPOOL | ACC-POOL | KASPA-POOL | HEROMINERS | OKMINER | WOOLYPOOLY | P1POOL | HIVEON | HASHPOOL |2 MINERS | EMCD.IO

Joining a pool can streamline your mining efforts, offering a more consistent payout.

Top Kaspa Miners of 2024

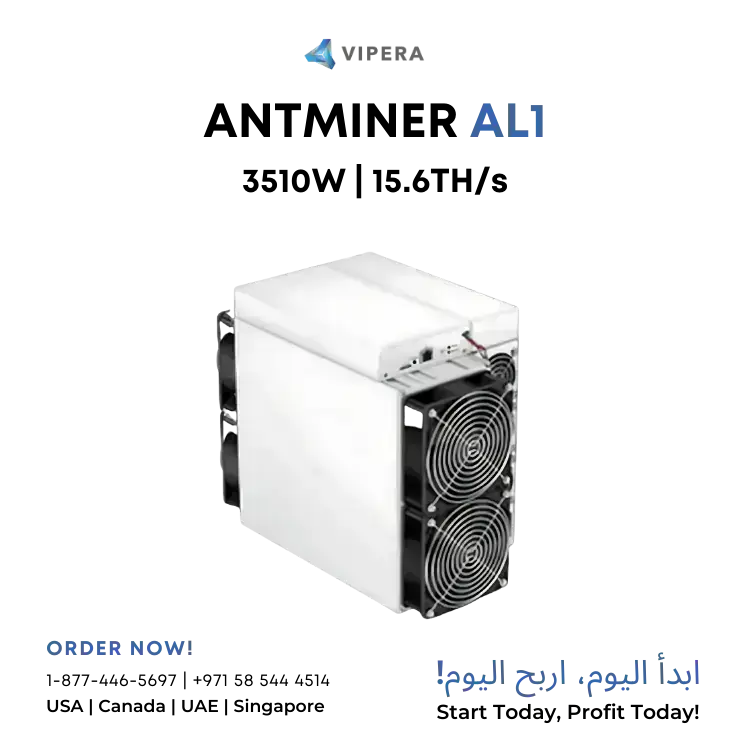

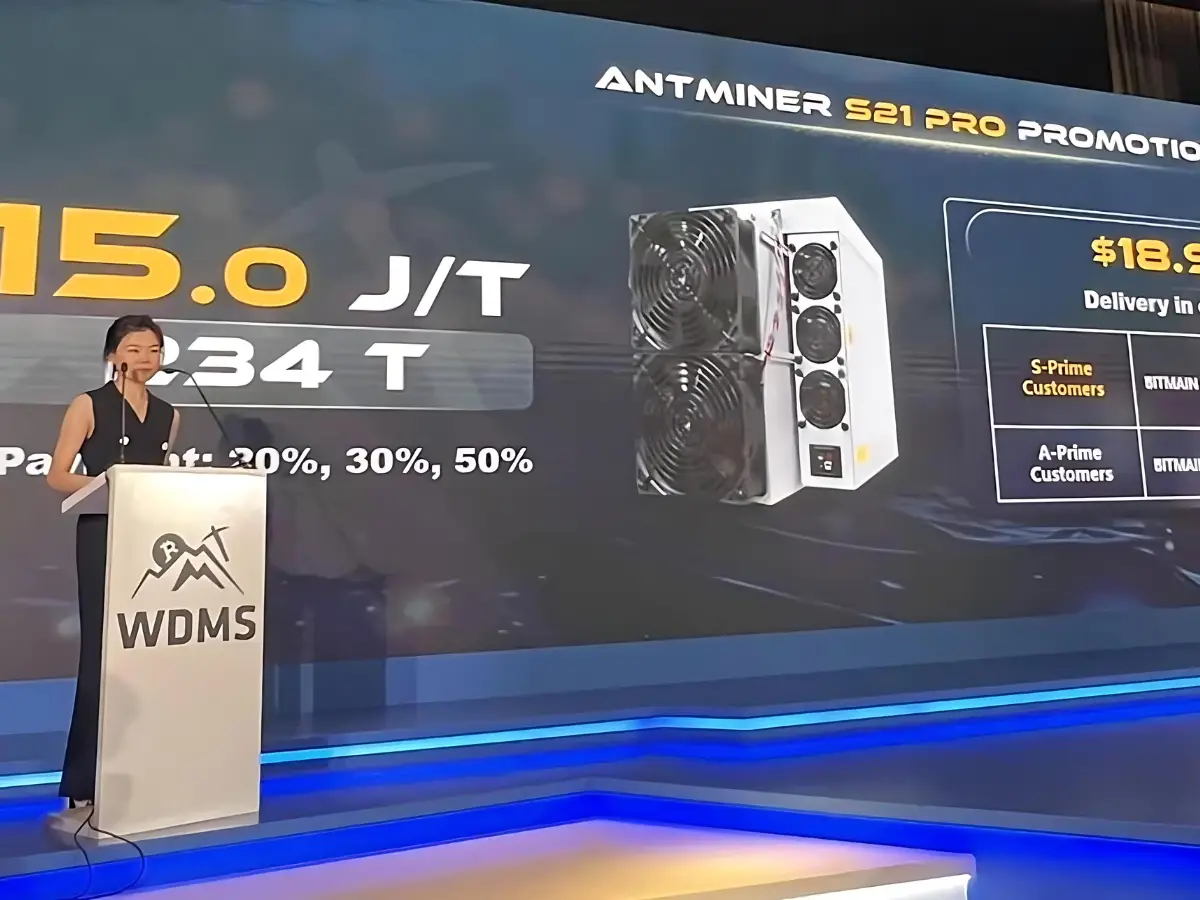

Let’s zoom in on the cream of the crop—the mining machines that are setting benchmarks in 2024.

✓ Model: KS5 and KS5 Pro

✓ Algorithm / Cryptocurrency: kHeavyHash / KAS-Kaspa

✓ Hashrate: 21 TH/s ±3%

✓ Power on wall @25°C, Watt: 4000 ±10%

✓ Power efficiency on wall @25°C, J/T: 190 ±10%

✓ Power supply AC Input voltage, Volt: 200~240

✓ Power supply AC Input Frequency Range, Hz: 47~63

✓ Power supply AC Input current, Amp: 20

✓ Networking connection mode: RJ45 Ethernet 10/100M

✓ Miner Size (Length x Width x Height, without package): 430 x 195.5 x 290 mm

✓ Miner Size: 570 x 316 x 430 mm

✓ Net weight: 16.1 kg

✓ Gross weight: 17.7 kg

✓ Operation temperature: 0~40 °C

✓ Storage temperature: -20~70 °C

✓ Operation humidity (non-condensing): 10~90%

✓ Operation altitude: ≤2000 meters

✓ Manufacturer: iBeLink

✓ Model: BM-KS Max

✓ Release Date: February 2024

✓ Size Without Packaging: 340 x 190 x 293 mm

✓ Size With Packaging: 424 x 289 x 388 mm

✓ Net Weight: 12.2kg

✓ Voltage: 190-240V

✓ Noise Level: 75 dB

✓ Fan(s): 4x 5,000 RPM Delta

✓ Power: 3,400W

✓ Interface: Ethernet

✓ Operating Temperature: 0 – 45 °C

✓ Humidity: 0 – 95 %

✓ Warranty: 6 months manufacturer repair, parts or replace

✓ Manufacturer: Bitmain

✓ Model: Antminer KS3 (9.4Th)

✓ Release: August 2023

✓ Size: 195 x 290 x 430mm

✓ Weight: 16100g

✓ Noise level: 75db

✓ Fan(s): 2

✓ Power: 3188W

✓ Interface: RJ45 Ethernet 10/100M

✓ Temperature: 5 – 40 °C

✓ Humidity: 10 – 90 %

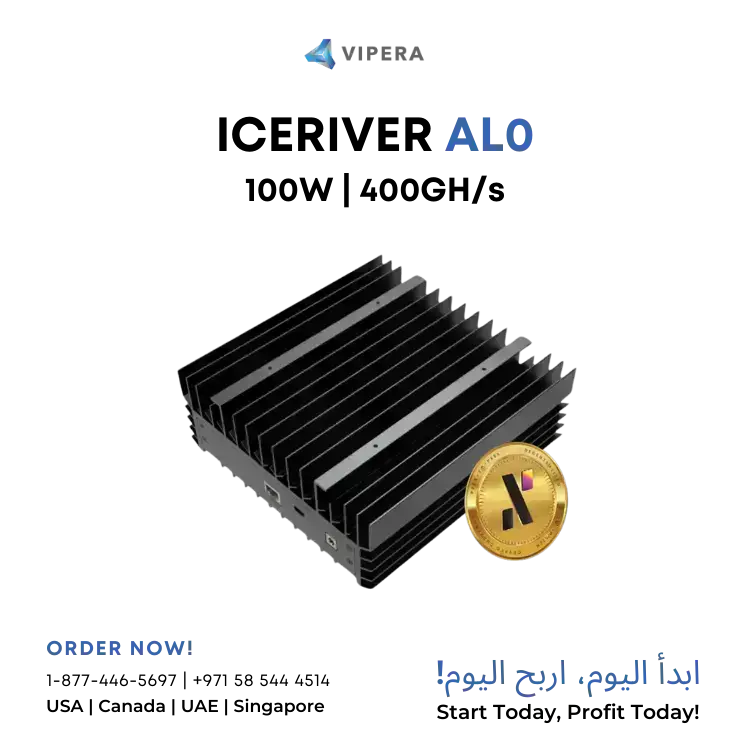

✓ KAS Hashrate: 200GH/s (±10%)

✓ Wall Power: 100W/h (±10%)

✓ Algorithm: kHeavyHash

✓ Dimension: 200x194x74mm

✓ Net Weight: 2.5kg

✓ Connection: Ethernet

✓ Noise Level: 10db

✓ With PSU: 100-240V AC

✓ Without PSU: 19-20V DC

✓ Operating Temperature: 0~35 ℃

✓ KAS Hashrate: 6TH/S (±10%)

✓ Wall Power: 3400W/h (±10%)

✓ Specifications: 6TH 3400W

✓ Dimension (with packaging): 490×300×400(mm)

✓ Dimension: 370×195×290(mm)

✓ Gross Weight: 17.1kg

✓ Net Weight: 14.4kg

✓ Connection: Ethernet

✓ Voltage Input: 170-300V AC

✓ Operating Temp: 0~35 ℃

Conclusion

Embarking on a Kaspa mining adventure in 2024 opens up a world of opportunities. With the right equipment, software, and mining pool, you can maximize your mining efforts and contribute to securing the Kaspa network. Remember, the key to successful mining lies in choosing the tools and resources that best align with your goals and capabilities. Happy mining!