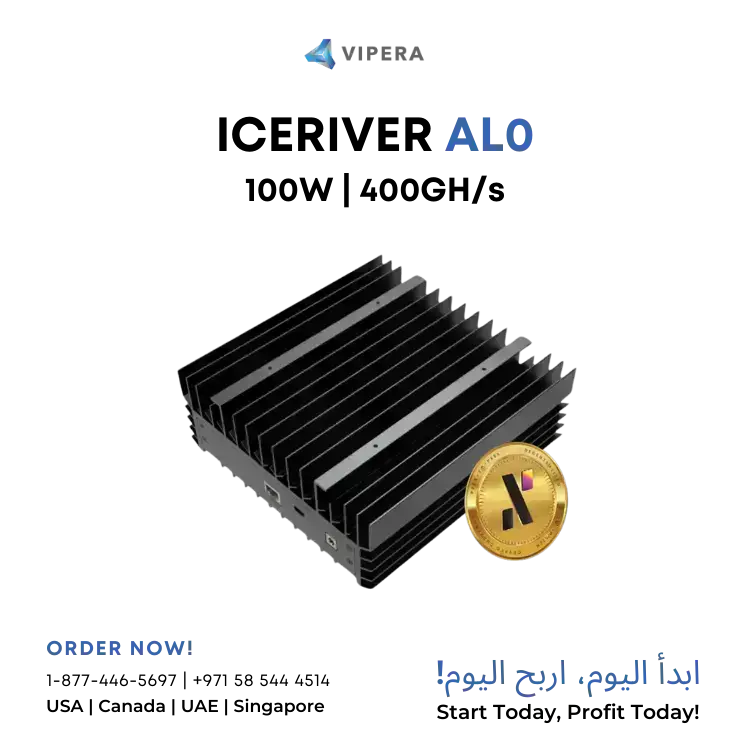

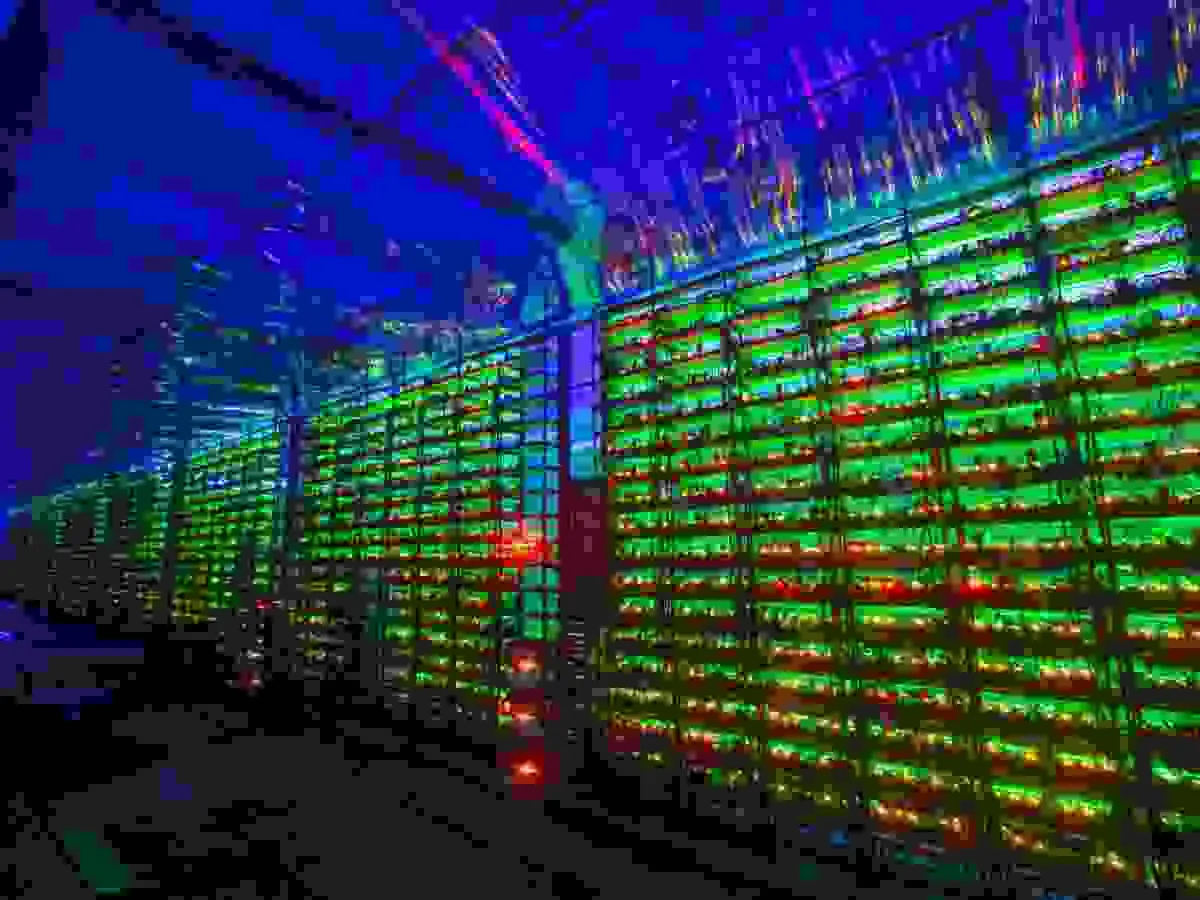

In the dynamic world of cryptocurrency mining, understanding the logistics and supply chain intricacies can significantly impact your mining strategy and bottom line. At Vipera, we’re committed to not only providing top-tier crypto mining hardware but also ensuring our customers are well-informed about the realities of global shipping practices. Here’s the lowdown on why crypto miners, especially those of high value like ASICs, are rarely shipped from the USA, and why Hong Kong plays a pivotal role in the crypto mining hardware market.

The Strategic Role of Hong Kong

Hong Kong’s status as a free trade zone is a major component to its appeal for manufacturers and resellers of ASICs and crypto related hardware. Since the Crypto mining ban imposed by China in 2021– shuttering factories and driving investment from this industry elsewhere– manufacturers such as Bitmain and MicroBT was left with no choice but to quickly relocate their factories to Malaysia, Vietnam and Indonesia. Banking operations followed suit, centralizing around Singapore, Hong Kong, the United States and the United Arab Emirates. The special designation of Hong Kong allows for the minimization of import tariffs on large volumes of goods, a cost-saving aspect that is crucial in the highly volatile crypto market.

All manufacturers funnel their goods through a few select warehouses in Hong Kong, primarily the Debon Express warehouse, where it is common for resellers to then bid on incoming and existing palettes of goods. This process ensures that ASIC miners, especially high-ROI altcoin miners, don’t simply languish in transit or on shelves, depreciating in value and losing income daily.

The Realities of "Shipping from the USA"

There’s a pervasive myth that some resellers claim crypto miners are readily shipped from the USA, Canada, or even Europe. The truth is, if you’re receiving new stock from these regions, it’s likely due to a previous transaction “falling through” where are a large amount of miners were imported and either abandoned or not fully paid, or you’re dealing strictly with returned or used items. The reason for this is quite simple: resellers are wary of “holding the bag” so to speak on expensive inventory that might not sell or could drop in value overnight. If there are in fact brand new miners shipping from these typically ‘end-user’ regions, they are in all likeliness SHA-256 (BTC) ASICs as the price for these are fairly stable versus their altcoin counterparts. Plus, the logistics of importing goods of high quantity to the United States (27% for example) entails unavoidable heavy import tariffs and longer transit times, especially when sea freight is concerned, which can significantly eat into profits and revenue generation.

The exception to this general rule is Russia, where SHA-256 miners are regularly stocked there since the commencement of the Ukraine conflict to skirt around sanctions. Russians have hedged deterioration against the ruble and shaky economic prospects by mining Bitcoin as a sort of insurance policy, and trade with Hong Kong and mainland China is welcome and does not require sea freight.

Market Volatility and Inventory Risks

The crypto market’s volatility plays a significant role in shipping logistics. Demand and the price of goods fluctuate daily, making it a gamble to stock large quantities of miners in any one location, which is especially true for high ROI altcoin miners. When values increase, products tend to sell out rapidly, leaving no room for stockpiling. These goods are typically shipped out directly from the Debon Express warehouse and are accounted for in most cases before they even arrive. This is a normal occurence for “futures” or “batch orders”. This ensures goods spend minimal time in transit and reduces the risk of depreciation.

The Advantage of Air Cargo and DDP Options

To navigate the challenges of market volatility and logistics, Vipera leverages air cargo for shipping smaller batches of miners and can split orders on numerous waybills if orders exceed 5-10 units. This method allows for quick delivery without the hefty tariffs associated with larger shipments as goods are assessed on exit, not on entry. Additionally, we offer Delivered Duty Paid (DDP) options for air freight to certain countries, including the USA and UAE, further streamlining the process for our customers. We only use Fedex, DHL and Aramex.

Vipera's Commitment: Absorbing Import Duties and Tariffs

At Vipera, we deeply understand the financial hurdles that import duties and tariffs can impose on our customers, especially those venturing into the dynamic field of cryptocurrency mining. This understanding drives our commitment to absorb these costs for shipments heading to North America, the GCC, and the European Union, ensuring a smoother, more predictable investment landscape for our clients. Our approach is designed not just to alleviate the burden of hidden fees but to empower our customers to focus on enhancing their mining operations without the worry of unforeseen expenses.

While this policy significantly reduces the financial strain on our customers, it’s important to note the potential for minor customs clearance brokerage fees, which may be collected by the carrier in certain regions. These fees are a standard part of the international shipping process, covering the services required to navigate goods through customs. Vipera’s initiative to cover import duties and tariffs highlights our dedication to transparency and customer support, aiming to foster a more accessible and less daunting entry into the world of crypto mining for enthusiasts and professionals alike.

Conclusion: Navigating Crypto Mining Logistics with Vipera

Navigating the intricate logistics of shipping crypto mining hardware involves a delicate balance of strategic planning, understanding market dynamics, and mitigating financial risks such as import tariffs and price swings. Vipera stands at the forefront of this challenge, committed to offering clarity and effective solutions to safeguard the investments of our customers. Our mission goes beyond merely supplying mining equipment; we aim to be a steadfast partner, providing our clients with the insights and support needed to thrive in the ever-evolving cryptocurrency mining landscape.

This commitment means that when you choose Vipera, you’re securing more than just state-of-the-art mining technology; you’re aligning with a team that’s deeply invested in your success. We navigate the complexities of global logistics, market volatility, and regulatory hurdles, so our customers can concentrate on maximizing their mining operations’ efficiency and profitability. With Vipera, you gain not just a supplier but a strategic ally, dedicated to empowering your journey through the dynamic world of crypto mining. Whether one unit or thousands, Vipera is diligently committed to getting your expensive goods in your hands headache-free.