Summary

When my mining rig first started losing hashrate, I didn’t realize overheating was the silent culprit. It wasn’t just a minor dip, it was cutting into my profits. That’s when I knew I needed a better cooling solution to protect both my hardware and my investment.

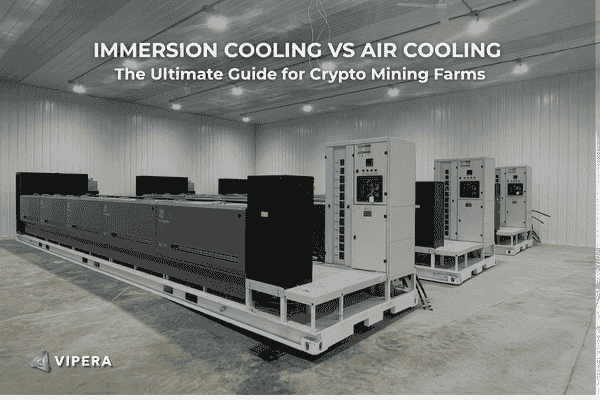

Efficient Bitcoin mining ASICs generate a tremendous amount of heat. Without proper cooling, performance suffers, hardware ages faster, and profitability takes a hit. Choosing the right cooling method whether air or water can make all the difference in maintaining stable performance and extending the lifespan of your equipment.

Curious about how other miners were tackling this challenge, I decided to dig deeper into the world of cooling systems. What started as a personal problem turned into a deep dive into the pros and cons of air cooling versus water cooling, and how each impacts mining efficiency, costs, and reliability.

Why Cooling Matters in Bitcoin Mining

If you’ve ever run a mining rig, you already know how much heat these machines produce. I learned this the hard way while setting up my first mining farm, temperatures climbed fast, and the performance dropped just as quickly. Effective cooling isn’t optional; it’s a core part of mining success.

When rigs overheat, they throttle performance to protect the chips, which directly reduces your hashrate and profits. Prolonged heat exposure can even damage components, leading to downtime and costly replacements. In short, cooling isn’t just about comfor it’s about protecting your ROI.

How Heat Affects Miner Performance

Every ASIC miner is basically a high-powered electric heater. Almost all the energy it consumes turns into heat. I still remember the first summer with my mining setup, I touched the case and it felt almost burning hot. Without proper cooling, that heat builds up quickly, pushing chip temperatures to dangerous levels. When chips get too hot, the miner’s built-in protection system kicks in, reducing hashrate or even shutting down entirely. I’ve even been jolted awake at night by alarms from overheating rigs.

Sustained high temperatures are brutal on hardware. Heat accelerates component wear and can cause solder joints to weaken over time due to constant thermal expansion and contraction. That means poor cooling doesn’t just slow performance it shortens your miner’s lifespan, forcing earlier replacements and raising long-term costs. After learning this lesson the hard way, I started treating the cooling system as one of the most critical parts of my operation. Keeping miners cool isn’t just about comfort it’s about stability, reliability, and consistent profit.

How Cooling Impacts Efficiency and Costs

Cooling directly affects how efficiently your mining operation runs. When temperatures climb too high, the hashrate drops and power efficiency worsens you’re paying for electricity that isn’t fully converted into mining output. Even worse, frequent restarts from overheating cause downtime, meaning lost income every time a machine goes offline.

Effective cooling, on the other hand, enables 24/7 stable performance at full speed. That’s where profitability really improves through uptime and consistency. But here’s the catch: cooling systems themselves consume power. Fans, exhaust units, and air conditioners all add to your total energy load. If your cooling system isn’t efficient, you end up spending more power just to keep things running a cycle that eats into profits

That’s why choosing the right cooling method is a balancing act between performance, power consumption, and operating cost. In short, cooling isn’t an optional add-on, it’s a key factor in mining profitability.

Air Cooling vs. Water Cooling: The Pros and Cons

I’ve worked with both air-cooled and water-cooled miners, and each comes with its own strengths and challenges. Air cooling is simple, affordable, and easy to set up perfect for beginners or smaller operations. But it’s loud, dust-prone, and heavily influenced by ambient temperature. Water cooling, on the other hand, is incredibly efficient and quiet, maintaining stable temperatures even in hot environments. However, it requires a more complex setup and a higher upfront investment.

Each approach can work well depending on your scale, climate, and budget the key is finding which one aligns with your mining goals.

Pros and Cons of Air-Cooled Miners

Most traditional mining rigs rely on air cooling and my first setup was no different. Each miner used multiple high-speed fans to push hot air out, relying on good ventilation to keep temperatures in check. The biggest advantage of air cooling is its simplicity and reliability. It’s plug and-play: just make sure your space has decent airflow, and you’re good to go. Air-cooled equipment is also more affordable, and swapping out a bad fan is quick and inexpensive. For a beginner or small-scale miner, this setup is ideal it helped me get started without overcomplicating things.

However, air cooling does have clear downsides. Its effectiveness depends heavily on ambient temperature. During hot and humid summers, even the best fans can only move warm air around, not cool it. I learned this firsthand after installing industrial exhaust fans and even adding air conditioning to help, which quickly drove up electricity costs.

Noise is another big issue. Air-cooled miners can be deafening under full load imagine standing next to a jet engine. I had to wear earplugs near my rigs, and running them anywhere near residential or office spaces was out of the question. Then there’s the problem of dust: the constant airflow pulls dust into the miner, coating chips and reducing cooling efficiency over time. Regular cleaning becomes a must.

In short, air cooling’s strengths lie in low cost, easy setup, and simple maintenance. But it struggles in hot climates, noise-sensitive environments, or high-density setups. For small-scale or budget-conscious miners, it’s still a practical choice. But as operations scale or conditions become tougher, air cooling starts to show its limits.

Pros and Cons of Water-Cooled Miners

As mining technology advanced, I began experimenting with water cooling and I was immediately intrigued by how it worked. Instead of relying on fans, water cooling uses circulating liquid to absorb heat from the miner’s chips and release it through a radiator or dry cooler. Because water has much higher thermal conductivity than air, it can transfer heat far more efficiently.

When I first tested a water-cooled miner, the results were impressive. Even at full load, the chip temperatures stayed low and stable, no throttling, no overheating. During the summer heat, water cooling became my secret weapon to keep performance consistent.

Another big win for water cooling is noise reduction. Since water-cooled miners don’t rely on rows of high-speed fans, they’re remarkably quiet just a low hum from the circulation pump. If your mining setup is near an office or residential area, this is a game changer. Fewer noise complaints, more peace of mind.

Of course, it’s not all upside. Water cooling is more complex and expensive to set up. It requires pumps, coolant, tubing, radiators, and water blocks, all of which add to the initial investment. When I built my first water loop, I ran into a leak, thankfully caught it early but it taught me that maintenance is critical. You need to regularly check seals, monitor coolant levels, and occasionally replace fluids or additives. Compared to dusting fans, it’s definitely more involved.

There’s also a hidden energy cost: pumps and chillers consume additional power. However, in large-scale farms, water cooling often proves more efficient overall because it eliminates the need for extra fans and air conditioning.

In summary, water cooling offers high efficiency, quieter operation, stable temperatures, and potentially longer hardware life. Its drawbacks are higher upfront cost, system complexity, and a steeper learning curve.

Air vs. Water Cooling: Side-by-Side Comparison

| Category | Air-Cooled Miner | Water-Cooled Miner |

Cooling Efficiency | Relies on air convection; efficiency drops in hot weather | Liquid directly absorbs and removes heat; highly efficient and stable |

Initial Cost | Built-in fans, minimal setup cost | Requires pumps, tubing, radiators; higher upfront investment |

Maintenance | Dust cleaning and fan replacement | Coolant checks, seal inspection, potential leak management |

Noise | Loud, unsuitable for populated areas | Quiet operation; ideal for noise-sensitive environments |

Installation | Needs open space and strong airflow | Requires piping, coolant loop, and some technical setup |

Best Use Case | Small to large operations with moderate climate and budget | High-density or professional farms needing tight temperature control |

Will Air-Cooled Miners Become Obsolete?

As more new-generation miners adopt water cooling, it’s fair to wonder if air-cooled systems are on their way out. In reality, air-cooled miners aren’t disappearing anytime soon. They remain the mainstream solution due to their simplicity, maturity, and lower costs.

That said, water cooling is steadily gaining traction especially in high-density farms and hot climates, where efficiency and uptime matter most. Over time, we may see a gradual shift: air cooling for small-scale and entry-level miners, and water cooling becoming the standard for professional operations.

Air Cooling Is Still the Current Mainstream

Even with all the buzz around water cooling, air-cooled miners still dominate the crypto mining landscape. From what I’ve seen, well over 80% of active miners still rely on air cooling and the reason is simple: it works, and it’s proven.

Air cooling technology has been around since the earliest Antminer models from the S5 and S9 series to the newer S19 units and it remains the standard across most mining farms. Everything from site layouts to ventilation systems and maintenance routines has been built around it. During my visits to large farms in Inner Mongolia and Xinjiang, I saw rows upon rows of roaring air-cooled miners running like clockwork. The system may be loud, but it’s reliable and reliability is everything in mining.

Another big advantage is cost. Air cooling remains the most affordable option. For miners working with tight budgets, it’s hard to justify the jump to water cooling when fans still get the job done. Setting up an air-cooled system is straightforward, you just need power, internet, and solid ventilation. In contrast, water cooling requires significant infrastructure changes and higher upfront investment. Especially during market downturns or when Bitcoin prices dip, miners tend to tighten their budgets, sticking with tried-and-true air-cooled setups rather than investing in new tech.

All these practical factors mean air cooling isn’t going anywhere anytime soon. It’s still the mainstream choice for most miners today.

The Impact of Water Cooling’s Rise

That said, there’s no denying that water cooling is gaining momentum. More high-end miners now come with water-cooled versions, such as Bitmain’s Antminer S19 XP Hyd, S21 Hydro, and MicroBT’s Whatsminer M56S Hydro. These models have caught the attention of serious operators thanks to their superior power efficiency and higher hashrate performance.

Many large-scale mining farms are already planning or building facilities specifically designed for water-cooled miners. By optimizing for water loops instead of air ducts, they can fit more miners per square meter, increasing hashrate density and overall efficiency.

But will water cooling completely replace air cooling anytime soon? Not yet. I believe the two technologies will coexist for quite a while. Air cooling will continue to serve small and mid-sized miners, retail users, and regions with low-cost electricity, where simplicity and affordability matter most. Meanwhile, water cooling will expand among professional, high-density operations that focus on performance, efficiency, and long-term sustainability.

Maybe years down the road, once most farms modernize, air cooling might start fading from the spotlight but in 2025, it’s still holding strong as the industry’s backbone.

Who Should Choose Air-Cooled Bitcoin Mining?

- Small-scale miners and beginners who want to start quickly without complex infrastructure.

- Budget-conscious operators who need a low-cost, reliable cooling setup.

- Locations with mild climates where high ambient temperatures aren’t a major issue.

Ultimately, the choice between air and water cooling depends on your scale, budget, and goals. Air-cooled mining is ideal for:

If you want a plug-and-play solution, lower upfront costs, and easy maintenance, air cooling remains a practical and proven choice. It may not be the most advanced, but for many miners especially those just getting started, it’s still the smartest way to go.

The First Choice for Beginners and Small Miners

If you’re new to Bitcoin mining or running just a few rigs, air cooling is almost always the go-to choice and that’s exactly how I started. The reason is simple: air cooling systems are straightforward, reliable, and require almost no technical expertise. I still remember unpacking my first Antminer, plugging in the power and Ethernet cable, hearing the fans roar to life and that was it. It started hashing right away. No water lines, no pumps, no coolant. Just pure simplicity.

For small-scale setups, the heat from a few air-cooled miners is manageable with basic ventilation. One of my friends runs three air-cooled miners in his garage he simply added an exhaust fan to push out the hot air. Months later, his setup is still running strong. For home or office environments, air cooling works perfectly well. It’s also more budget-friendly since you don’t have to invest in additional components like water blocks or pumps. For most beginners, that’s a major plus.

For Budget-Conscious and ROI-Focused Miners

If you’re the kind of miner who carefully tracks every dollar and focuses on return on investment (ROI), air cooling often makes the most financial sense. The lower upfront cost shortens the payback period and minimizes risk. Even if air cooling is slightly less efficient than water cooling, the money you save can often be put toward buying extra machines increasing total hashrate and profit potential.

For example, I once advised a client choosing between 10 air-cooled miners or 8 water-cooled ones. His local power costs weren’t too high, so we calculated that the extra two air-cooled miners would actually generate more total output than the energy savings from water cooling. The decision was simple: go with air.

In some environments, water cooling isn’t even practical. Sites without a reliable water source, spaces where piping can’t be installed, or rented facilities with restrictions often can’t support liquid systems. In these cases, air cooling isn’t just a cost decision — it’s the only viable option. I know a miner operating in a remote, dusty region who relies entirely on air cooling. With added dust filters and regular cleaning, his setup runs efficiently year-round. Sometimes, practicality wins over perfection.

For Miners Who Value Flexibility and Easy Maintenance

Miners who like to experiment, move equipment often, or upgrade rigs frequently tend to stick with air cooling. Why? It’s flexible and easy to manage. You can shut down, unplug, and relocate miners with minimal hassle. Water cooling, on the other hand, involves draining coolant, disconnecting pipes, and reassembling everything not exactly plug-and-play.

If you don’t have a full-time technician or prefer handling maintenance yourself, air cooling is far more forgiving. Dusting fans or replacing a unit can be done in minutes. For small and medium-scale farms where the owner manages operations personally, air cooling remains the most convenient and low-stress solution.

Who Is Air-Cooled Bitcoin Mining Best Suited For?

| User Type | Why It Fits |

Mining Beginners/Newbies | Simple setup, no technical skills required, easy to start mining |

Small-Scale Farm Owners | Few devices; natural ventilation is sufficient; minimal investment |

Budget-Conscious Miners | Low upfront cost, faster ROI, and reduced investment risk |

Frequent Upgraders | Flexible and easy to modify; adding or removing miners is quick |

Solo Operators (No Tech Team) | Maintenance is simple; can be handled by one person

|

Recommended Air-Cooled Bitcoin Miners

Bitmain Antminer S23 (318T)

Bitmain Antminer S21+ (216T)

Antminer S19K Pro (115T–120T)

These models offer reliable performance and are well-supported by existing air cooling setups — ideal for miners looking to balance efficiency, stability, and affordability.

Who Is Water-Cooled Bitcoin Mining Suitable For?

Compared to air cooling, water-cooled mining caters to a different type of miner — those who are ready to invest in performance, efficiency, and long-term stability. Water cooling isn’t just a luxury upgrade; it’s a strategic choice for large-scale operations, well-funded investors, and miners focused on the future.

1. Large Farms and Professional Investors

The first group that benefits most from water cooling are large farm operators. When you’re managing hundreds or even thousands of miners, cooling becomes a critical bottleneck and this is where water cooling truly shines.

I once visited a water-cooled mining farm packed with rows of piping and massive heat exchangers the setup was impressive. At that scale, water cooling’s efficiency allows farms to fit more miners in the same space while keeping temperatures under control. One client in the Middle East switched to water cooling for exactly this reason. With scorching outdoor temperatures but access to cheap electricity, they wanted to maximize miner density. Water cooling solved their heat management challenges and boosted their overall output per square meter.

Professional investors and established mining companies are also drawn to water cooling. These groups typically take a long-term view, focusing on lifecycle ROI rather than just upfront cost. Cooler-running miners tend to last longer and maintain consistent performance, offsetting the higher installation expense. Since large operations usually have their own engineering teams, maintenance and system complexity aren’t major hurdles. For these players, water cooling is a smart long-term investment rather than an unnecessary upgrade.

2. Miners with Environmental or Regulatory Requirements

In some cases, miners turn to water cooling out of necessity. Farms located in cities or densely populated areas often face strict noise and heat regulations. Water cooling’s quiet operation and controlled heat discharge make it ideal for these environments.

I saw a great example of this in Shenzhen, a setup running water-cooled miners inside an office building. The system routed heat outdoors through exchangers, keeping the indoor environment cool and quiet. The miners operated discreetly, without disturbing anyone nearby.

Water cooling also appeals to eco-conscious miners and operators working under environmental standards. The higher efficiency translates to less power consumed per hash, and most water systems are closed-loop, meaning they conserve water and minimize waste. Some Nordic mining farms have even taken it a step further reusing miner heat to warm nearby buildings. It’s a win-win model: efficient mining and sustainable energy use.

3. Miners Focused on Peak Performance and Long-Term Returns

Then there are the performance enthusiasts miners who love to optimize every watt and chase the best efficiency possible. For these operators, water cooling unlocks new levels of control. Lower operating temperatures allow for safe overclocking and stable high-speed performance.

A friend of mine, a true mining enthusiast, once experimented with immersion cooling to overclock older miners he loved pushing hardware to its limits. Water cooling offers similar benefits but in a safer and more stable form, backed by official manufacturer support.

Long-term miners also gravitate toward water cooling. They’re not chasing quick profits but planning for 5–10 years of consistent operation. For them, the upfront investment is justified by years of reduced operating costs and longer hardware life. In the long run, the numbers often work out in their favor. Personally, I’m considering adding water cooling to my own farm as it scales, once I secure long-term power contracts, the efficiency gains will make it a smart next step.

Who Is Water-Cooled Mining Best Suited For?

| User Type | Why It Fits |

Large Farm Operators | Need high-density setups; water cooling increases stability and space efficiency |

Well-Funded Miners or Companies | Focus on long-term ROI; can handle higher initial costs for better durability |

Operators in Noise- or Heat-Restricted Areas | Quiet and controlled operation; suitable for urban or indoor environments |

Eco-Friendly / Energy-Efficient Miners | High energy efficiency, reduced emissions, and potential for heat reuse |

Technically Skilled Teams | Have the expertise to manage complex systems and maximize performance

|

Recommended Water-Cooled Bitcoin Miners

Antminer S23 Hyd 3U (1160T)

Antminer S23 Hyd (580T)

Whatsminer M63S (360T–390T)

These models are built for efficiency, reliability, and high-density deployment perfect for farms ready to move into the next generation of professional Bitcoin mining.

Detailed Cost Analysis: Air Cooling vs. Water Cooling for Bitcoin Mining

Performance and efficiency are only part of the equation when it comes to mining, the numbers decide everything. So, let’s break down the economics behind air and water cooling. After analyzing costs from purchase to maintenance, the results are clear:

Air cooling wins on simplicity and lower upfront investment.

Water cooling offers slightly better power efficiency but comes with higher setup and maintenance costs that only pay off over time.

Initial Purchase Cost Comparison

When you buy miners, water-cooled versions often carry a significant premium.

For example, the air-cooled Bitmain Antminer S21+ (≈ 235 TH/s) is priced around US $3,500.

The water-cooled version, the Antminer S21+ Hydro (≈ 358 TH/s), is roughly US $5,300–5,600, sometimes listed as high as US $6,300 in some markets.

So even before cooling infrastructure, you're paying 30-60% more just for the unit. And that’s just the miner, water cooling requires additional gear: water blocks, tubing, pumps, coolant, heat exchangers/radiators. I estimated that converting 20 miners to water cooling could cost as much as buying several extra miners.

By contrast, air cooling usually just needs decent ventilation and perhaps upgraded fans comparatively cheap. For smaller operators especially, that cost saving goes straight to your budget and ROI.

Electricity and Efficiency Cost Comparison

Electricity is the largest ongoing cost and cooling methods play a big role.

Miner-only figures: Air-cooled S21+ at ~3,564 W (~15.2 W/TH) vs water-cooled S21+ Hydro at ~5,360 W (~15.0 W/TH).

So water cooling gives a modest efficiency gain (~10% better).

But we need to see the whole system:

| Metric | Air-Cooled S21+ (~235 TH/s) | Water-Cooled S21+ Hydro (~358 TH/s) |

Miner Power (Watts) | 3,564 W | ~5,360 W |

Daily Consumption (kWh) | 85.5 kWh | 128.6 kWh |

Cooling Power | Built-in fans (~300 W) + possible AC/fans | Pump (~200 W) + external cooling system |

Approx. Daily Electricity Cost (at US$0.07/kWh) | US$6.00 | US$9.00 |

Approx. Cost per TH/s per day | US$0.025 | US$0.025

|

Maintenance & Operational Cost Comparison

Maintenance is where cooling choices really diverge.

Air Cooling:

- Routine tasks: dust cleaning, fan replacement.

- No major infrastructure.

- Maintenance cost: low.

- Skill level: moderate.

Water Cooling:

- Tasks: coolant replacement or topping-up every 6-12 months, pump and seal checks, leak detection, possibly specialized technicians.

- Risk: leaks, corrosion, additional downtime.

- Skill level: higher.

- Maintenance cost: significantly higher over time.

If you’re a small to medium operator doing maintenance yourself, air cooling remains clearly lower cost and lower risk.

Comprehensive Cost-Benefit Takeaway

Here’s the summary view:

Air Cooling = Lower upfront investment + simpler maintenance + faster payback. Slightly higher energy cost per TH/s, but controllable.

Water Cooling = Higher upfront cost + more complex system + higher maintenance. But lower energy cost over large scale + longer component life + better performance/hardware stability.

Think of it like: buying a standard car vs. hybrid. The hybrid costs more upfront but pays back over time if you drive enough. If you only drive a little, the standard car is more cost-efficient.

Bottom line: Choose based on scale, budget, electricity cost, and how long you plan to run. I advise all miners to create a cost-comparison spreadsheet: unit price, cooling infrastructure, electricity rate, maintenance, lifespan then calculate ROI for both options.

How to Choose Between Air and Water Cooling for Bitcoin Mining

After understanding the differences between air and water cooling, the next question is: which one is right for you? The answer depends on several key factors; your farm’s size, budget, electricity cost, environment, and technical capability. In short:

Smaller-scale or budget-conscious miners should lean toward air cooling.

Larger, long-term, or high-efficiency operations will benefit more from water cooling.

Let’s break it down step by step.

1. Farm Scale and Number of Devices

Your operation’s size is one of the most important factors.

- Small farms (fewer than 50 miners) are usually best served by air cooling. The heat from a handful of devices can be handled with basic ventilation — fans, ducts, or a simple exhaust system. When I ran about a dozen miners, air cooling was more than enough. Water cooling at that stage would’ve been overkill.

- Medium-sized farms (50–200 miners) sit in the middle ground. You can still use air cooling effectively, but as density grows, heat buildup becomes a problem.

- Large-scale farms (hundreds or thousands of units) start hitting the limits of air cooling. At this point, you’ll either have to reduce power per unit (which cuts hashrate) or invest in stronger, more efficient cooling — that’s where water cooling excels.

Rule of thumb: under a few dozen miners, go with air cooling; above a few hundred, start considering water cooling seriously.

2. Budget and Return on Investment (ROI)

Your budget and payback expectations can make or break your decision.

If funds are tight and you want a quick ROI, air cooling is the safer bet. The lower upfront cost reduces financial pressure and risk. For small operations, I’ve calculated that air-cooled setups often reach payback within 12–14 months.

Water cooling, on the other hand, can easily double the initial investment, extending payback to 2–3 years or more. That’s a long horizon for small miners or those unsure about long-term stability.

Electricity costs also play a big role:

- In regions with high electricity prices (e.g., $0.10–$0.15 per kWh), water cooling’s efficiency can make a noticeable difference in profitability.

- In low-cost regions (e.g., hydro-powered farms paying $0.03–$0.04 per kWh), air cooling usually win miners prefer to buy more rigs rather than better-cooled ones.

When calculating ROI, always include equipment amortization, electricity costs, and expected hardware lifespan. The right cooling choice depends on how quickly you want to recover your investment and how long you plan to mine.

3. Operational Environment and Constraints

Your local environment climate, space, and regulations often determines your cooling choice more than anything else.

- Cold regions like northern Canada or Inner Mongolia can take advantage of free natural air cooling. Simply ducting cold outdoor air can drastically cut costs.

- Hot, humid areas such as the Middle East or Southeast Asia push air cooling to its limits. Electricity for air conditioning skyrockets, and only water cooling can efficiently handle the heat.

- Urban or regulated areas may have strict noise and heat-dissipation rules. Water cooling, being closed-loop and quiet, is easier to permit and maintain indoors.

I once consulted on a city mining project that had to meet fire safety and noise regulations. They ended up using a hybrid immersion system similar in principle to water cooling because traditional air systems couldn’t meet compliance standards.

4. Technical Capability and Maintenance

Your own or your team’s technical ability matters a lot.

Air cooling is straightforward anyone can manage it with basic tools. Water cooling, however, involves plumbing, pressure checks, and coolant management. If your team lacks experience or local technicians, jumping into water cooling can introduce costly risks.

That said, if you’re technically inclined or have an HVAC-trained team, water cooling opens the door to higher performance and long-term efficiency.

A practical approach is to start small: deploy mostly air-cooled miners and experiment with a small water-cooled batch. This lets you gain hands-on experience and confidence before scaling up. Many successful farms operate exactly this way mostly air-cooled, with a growing share of water-cooled rigs as they expand.

5. Cooling Recommendations by Scenario

Farm Situation | Recommended Cooling | Reason |

< 50 miners, tight budget | Air Cooling | Low investment, easy setup |

Cool climate, good airflow | Air Cooling | Leverage natural cold air (“free cooling”) |

100+ miners, high density | Water Cooling | Improves heat removal and uptime |

Hot, humid, poor ventilation | Water Cooling | Handles heat efficiently and prevents throttling |

High electricity cost (> $0.10/kWh) | Water Cooling | Lowers power waste, better efficiency |

Cheap electricity (< $0.05/kWh) | Air Cooling | Cheaper to buy more miners |

Urban or noise-sensitive location | Water Cooling | Quiet operation, easier compliance |

No technical staff, self-managed | Air Cooling | Simple and low-maintenance |

Has engineering team, long-term plan | Water Cooling | Optimized for performance and stability |

This table isn’t absolute, but it gives a strong starting point. Every miner’s situation is unique always evaluate your own goals, costs, and constraints before committing.

6. Air Cooling vs. Water Cooling ROI Example

Let’s illustrate with a quick example under the same conditions:

Factor | Air-Cooled Miner (S21+ 235T) | Water-Cooled Miner (S21+ Hydro 358T) |

Purchase Price | $3,500 | $5,500 |

Power Efficiency | 15.2 W/TH | 15.0 W/TH |

Daily Electricity Cost (@ $0.07/kWh) | $6.00/day | $9.00/day |

Expected Hashrate Revenue (@ $0.075/TH/day)** | $17.63/day | $26.85/day |

Estimated Payback Period | ≈ 12–14 months | ≈ 22–28 months |

Even though the water-cooled miner earns more daily due to higher hashrate and efficiency, the higher upfront cost stretches the payback period. Over 3–5 years, however, water cooling’s improved durability and lower downtime can tilt the balance in its favor.

Final Verdict: Which Cooling Method Should You Choose?

Both air and water cooling have their place in the evolving world of Bitcoin mining. The best choice ultimately depends on your operation size, budget, environment, and long-term vision.

- Choose Air Cooling if you’re a beginner, small-scale miner, or working with a limited budget. It’s affordable, easy to maintain, and flexible, perfect for getting started or running a simple setup in moderate climates.

- Choose Water Cooling if you’re a large-scale or professional operator with technical expertise and capital to invest for the long term. It delivers superior efficiency, quieter operation, and extended hardware lifespan, all of which translate to better performance and profitability over time.

At the end of the day, the most profitable miners are not necessarily the ones with the latest technology but the ones who choose the right tools for their environment and scale.

If you’re still unsure which path suits your setup best, our team at Viperatech can help you analyze your specific conditions from power availability and climate to ROI projections and recommend the optimal mining hardware and cooling solution for your needs.

👉 Contact Viperatech to get personalized guidance, compare air- and water-cooled miners, and build a cooling strategy that maximizes your performance and long-term profitability.