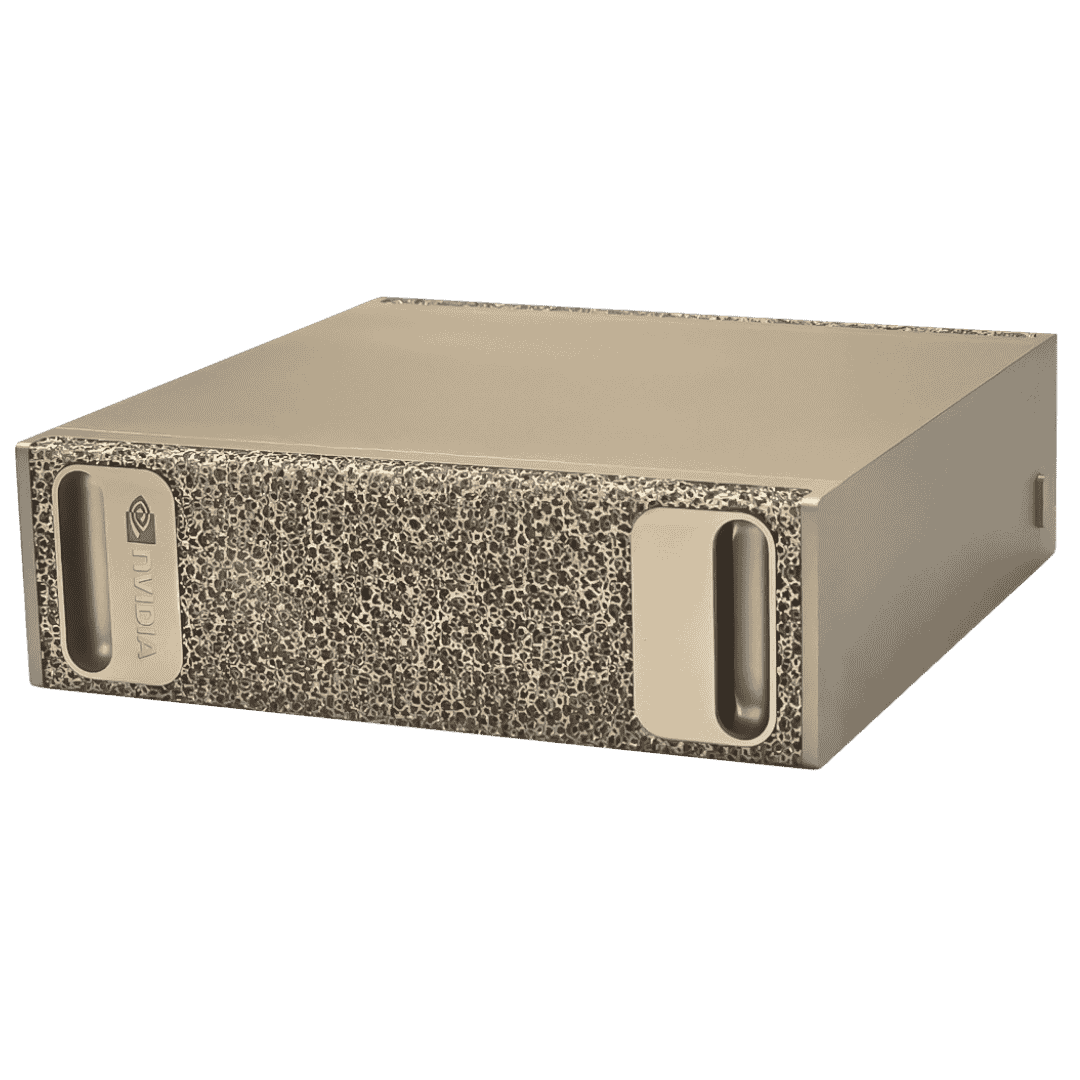

Welcome to the future of independent mining farms. Since the beginning of cryptocurrency mining, the major problem for those wanting to step up their mining production has been scaling solutions. The high costs associated with purchasing a warehouse or dedicated mining facility along with the management of the space, electrical costs, lost efficiencies and security protocols have always kept people from creating their own mining farms. That is until Bitmain came to the rescue. With dedicated, movable, independent mining farms solutions, Vipera LLC is proud to provide you with the Bitmain Antbox N5 V2.

What is an Antbox?

The Bitmain Antbox is an independent, self-contained cryptocurrency mining farm solution. A dedicated space for all your crypto mining processes, built from the ground up with a sole focus of creating an integrated mining facility for the ultimate hashrate to energy efficiency output possible.

Why is the Bitmain N5 V2 Special?

Bitmain has pulled out all the stops and packed the Anbox N5 V2 with features that help miners achieve industry crushing hashrates and minimal electricity costs such as a fanless design equipped with cooling pads and inlet/outlet shutters that help it reach a power usage effectiveness (PUE) of extreme efficiency. This is an important factor when scaling solutions for mining farms as electrical costs can ruin profits and prevent a quick return on investment (ROI).

The Bitmain Antbox is designed to accommodate 207 S19 model ASIC’s and is exclusive to the S19/S17/T19 “double-stack” format. When we look at the current mining capabilities of the S19, with a hashrate of 95TH/S it can mine around $30 (USD) per unit per day. This would allow miners to make an extremely lucrative income stream of around $6,000 a day, up to $2,400,000 a year. The Antbox is stackable vertically up to 3 units and horizontally stackable up to 6 units, this helps streamline space management efficiency and reduce costs associated with purchasing land.

An important factor to consider when getting into cryptocurrency farming is deployability and this is one of the things Vipera loves about the Antbox. It is easy to set up, comes preset from the factory and can be moved without hassle. Built with flame-retardant, fireproof materials and environmentally protective, energy-saving systems, Bitmain has ensured the Antbox’s electrical features meet UL/CUL standards and is certified by the Chinese Classification Society. The rugged, durable build of this unit allows it to be used year-round.

Efficiency is the end goal when mining cryptocurrency and with a top wiring grid bridge for better cable cooling and a heat dissipation water curtain to reduce internal running temperatures, owners of the Bitmain Antminer N5 V2 can rest comfortably at night knowing they have the optimal conditions for mining the SHA-256 algorithm for Bitcoin, Acoin, Terracoin and more. Security features are always necessary and even more so when you step up operations and start a cryptocurrency mining farm. This is why the Antminer N5 V2 comes equipped with a security camera, an internal emergency exit button for safety. On top of all of these components, buyers will also get a 3D recognition face scanner that is to be installed on-site.

Conclusion

If building a cryptocurrency mining farm is the next step on your path to financial freedom, or if you are just interested in investing in the cryptocurrency mining sector then the Bitmain Antbox N5 V2, with all of its efficiency features and security systems, is the right path to take. Viperatech.com has secured 15 of these unique units and is currently selling the Bitmain Antbox at $63,000(USD), down from $79,000 with savings of $16,000. Investors can expect a Return on Investment (ROI) after their first year, depending on additional operational costs such as electricity, land management and staffing.

Statistics

| Version | ANTBOX N5 V2 |

| Overall dimensions (L, W, H) (mm) | 6058x2438x2896 |

| Miner capacity | 19/17 series miner is 180 units |

| Voltage Input and frequency | 380V~415V AC 50~60HZ |

| Overall weight (ton, excluding miner) | 3.8 |

| Operating power (KW) | 658 |

| Standard power (KW) | 658 |

| Miner power cable | 360 |

| Safety certificate | Industrial Control Panel, PDUs, cables, switches, network cables, etc are certified by UL/CUL. |

| Main switch of Industrial Control Panel (A) | 1200 |

| Rated current (A) | 1000 |

| Maximum power (KW) | 719 |

| Single PDU rated current (A) | 31 |

| Overall weight (ton, excluding miner) | 3.8 |

| Single unit rated current (A) | 18 |

| 2500KVA transformer can bring Antbox quantity | 4 |

| Snow load (KN/㎡) | 3.5 |

| Industrial Control Panel | 1 |

| Panel to PDU power cable | 30 |

| PDU | 30 |

| Network Switch | 15 |

| Network cable | 180 |

About Vipera LLC

Viperatech is a premier source for selective, highly sought-after electronics and cutting edge technology solutions catering to the digital advertising, cryptocurrency mining hardware, A.I processing, corporate I.T. and PC gaming industries. For more information, contact us at 1-877-446-5697 or email us at info@viperatech.com.

Links

viperatron.com/product/antbox-v2-n5/

asicminervalue.com/miners/bitmain/antminer-s19-95th

support.bitmain.com/hc/en-us/articles/4406863706393-Certificate-of-Conformity-for-ANTBOX-N5-V2