Ever wondered how you can mine multiple cryptocurrencies at once? Merged mining might be the answer! Dive into our comprehensive guide to understand what merged mining is, how it operates, and why it’s beneficial for the crypto mining community.

What is Merged Mining?

Merged mining is an innovative technique that allows miners to mine multiple Proof-of-Work (PoW) based cryptocurrencies simultaneously, provided they share the same hashing algorithm. By using the same mining hardware, miners can contribute their computational power to multiple blockchains at once, earning rewards from each. The concept of merged mining was first proposed by Satoshi Nakamoto, the anonymous creator of Bitcoin, back in 2010. This method enabled miners to mine another cryptocurrency alongside the primary blockchain, Bitcoin. The secondary blockchain involved in this process is known as an auxiliary blockchain.

For merged mining to work, the auxiliary cryptocurrency must utilize the same hashing algorithm as the primary cryptocurrency. In the case of Bitcoin, this algorithm is SHA-256.

How Does Merged Mining Work?

Merged mining works by allowing miners to solve cryptographic puzzles for multiple blockchains using a single piece of work. Here’s a simplified explanation of the process:

Mining Setup: Miners set up their mining hardware and software to support both the primary blockchain (e.g., Bitcoin) and the auxiliary blockchain (e.g., Namecoin).

Block Creation: Miners create a block for the primary blockchain, which includes a block header, transaction data, and a nonce.

Hash Calculation: The miner calculates the hash of the block header. If the hash meets the difficulty target of the primary blockchain, the block is valid for that blockchain.

Proof Submission: The same proof-of-work is submitted to the auxiliary blockchain. If the hash also meets the difficulty target of the auxiliary blockchain, the block is valid for that blockchain as well.

Requirements for Merged Mining

If you’re interested in participating in merged mining, which allows you to mine multiple cryptocurrencies simultaneously, there are several key elements you’ll need to ensure success. Here’s what you’ll need:

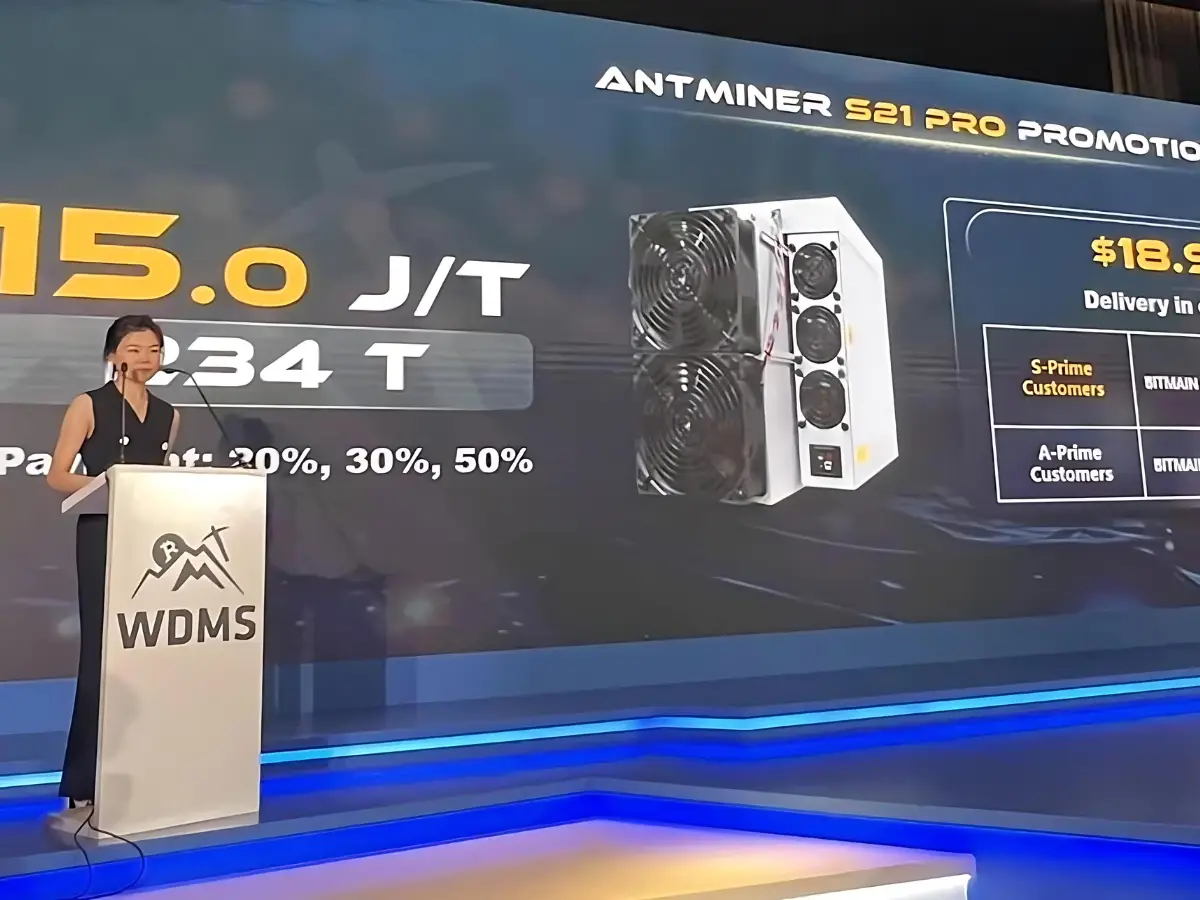

1. Suitable ASIC Miner

You must have an Application-Specific Integrated Circuit (ASIC) miner that is tailored for the primary cryptocurrency blockchain you wish to mine. For example, if you’re focusing on Bitcoin and other related cryptocurrencies, you’ll need an ASIC miner optimized for the SHA-256 algorithm.

2. Compatible Mining Pool

Choose a mining pool that supports merged mining and the specific cryptocurrencies you’re interested in. The mining pool should offer merged mining services. For instance, if Bitcoin is your primary blockchain, the pool should enable you to mine all associated cryptocurrencies that use the SHA-256 algorithm, such as Bitcoin SV and Bitcoin Cash.

3. Supportive Auxiliary Blockchain

To mine multiple cryptocurrencies, you need an auxiliary blockchain that supports merged mining. This requires AuxPoW (Auxiliary Proof-of-Work) support. Not all blockchains that share the same hashing algorithm support AuxPoW, so it’s crucial to verify this before starting with merged mining.

By ensuring you have the right ASIC miner, choosing a compatible mining pool, and verifying AuxPoW support on auxiliary blockchains, you can successfully engage in merged mining and optimize your cryptocurrency mining efforts.

Advantages of Merged Mining

Increased Efficiency Merged mining allows miners to simultaneously mine multiple cryptocurrencies on both the primary and auxiliary blockchains, maximizing their hardware utilization.

Enhanced Mining Rewards By participating in merged mining, miners can receive rewards from both the primary and auxiliary blockchain networks, potentially leading to higher overall profits.

Disadvantages of Merged Mining

Complex Setup Implementing merged mining can be technically challenging and requires a high level of technical expertise. The setup is more intricate and demands more effort compared to mining on a single blockchain.

Dependence on Parent Blockchain The security of the auxiliary blockchain depends on the hash power of the parent blockchain. This means that the auxiliary chain’s security is directly tied to the strength and stability of the primary blockchain.

Merged Mining Algorithms and Considerations

Merged mining primarily involves the SHA-256 and Scrypt algorithms. However, it’s important to note that not all mining pools provide merged mining services. Therefore, miners need to thoroughly investigate the pool’s merged mining offerings and the supported cryptocurrencies before proceeding.

Prominent examples of merged mining include Bitcoin and Namecoin. Additionally, Litecoin and Dogecoin can be mined together. Despite the potential benefits, merged mining requires a high level of technical expertise due to its complex design.

Conclusion

Merged mining is a distinctive approach in the blockchain space, allowing miners to simultaneously mine multiple cryptocurrencies. This can lead to increased mining profits. However, it requires significant technical expertise. To succeed in merged mining, miners should continuously educate themselves about the latest trends and advancements in the blockchain and cryptocurrency industries.

FAQs

Is Merged Mining More Energy Efficient?

Merged mining can make the Proof of Work (PoW) mechanism more energy efficient. This is because the energy expenditure is shared between the two blockchain networks, which can lead to enhanced mining profits for the user.

Risks Associated with Merged Mining

One of the risks associated with merged mining is that as more users participate across multiple chains, the increasing mining difficulty of auxiliary chains can eventually hinder miners from effectively leveraging these auxiliary blockchains. This escalation in difficulty may diminish the potential benefits of merged mining over time.